The world of finance is undergoing a seismic shift, propelled by the relentless march of technology. At the heart of this transformation is the emergence of e-banks, digital institutions that are rewriting the rules of traditional banking. From their humble beginnings as online offshoots of brick-and-mortar banks, e-banks have evolved into full-fledged financial institutions, offering a comprehensive range of services with unparalleled convenience and accessibility. This article delves into the rise of e-banks, exploring their origins, defining their key characteristics, analyzing their advantages and limitations, and examining their impact on the financial landscape. We will also discuss the future of e-banking, considering emerging trends and potential challenges.

The Genesis of E-Banking

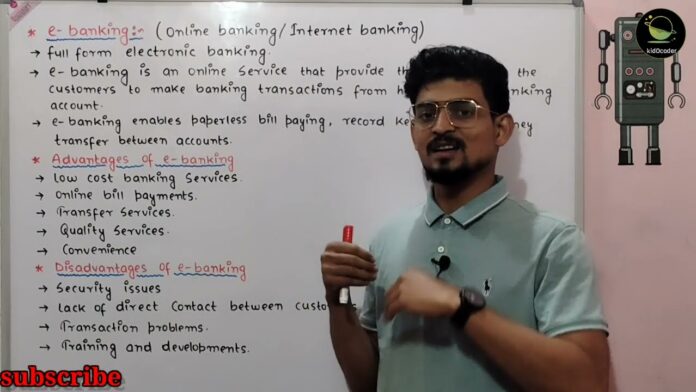

The roots of e-banking can be traced back to the early days of the internet. In the 1990s, traditional banks began experimenting with online platforms, offering basic services like balance inquiries and bill payments. These early iterations were largely extensions of existing branch-based operations, offering limited functionalities. However, the dawn of the 21st century witnessed a profound shift in the landscape. The rise of smartphones, the proliferation of internet access, and the increasing adoption of online services created fertile ground for the growth of e-banks.

As technology continued to advance, e-banks started to offer more innovative solutions, such as online account opening, digital loan applications, and round-the-clock customer service. With the rise of fintech companies, e-banks also began partnering with these startups to provide specialized services like peer-to-peer lending, robo-advisory, and cryptocurrency trading. Today, e-banks have become major players in the banking industry, challenging traditional banks with their disruptive business models and cutting-edge technologies.

Simplifying Tuition Payments and Financial Transactions for Students

One of the primary benefits of e-banking is its ability to streamline financial transactions, making it an ideal solution for students who often face challenges with managing their finances. With the integration of e-banking with online learning platforms, universities and educational institutions can provide students with a one-stop-shop for all their financial needs.

Online Tuition Payment

Traditionally, students have had to navigate long queues and cumbersome processes to pay their tuition fees at the university’s finance office. With e-banking, this process is simplified, as students can now make payments online through their designated e-banking platform. This not only saves time and effort but also provides a more secure method of payment.

Some e-banks even offer features such as automatic reminders for payment due dates and installment options for tuition fees. This eliminates the risk of late payments and allows students to better manage their finances.

Digital Loans and Scholarships

E-banks also offer students access to digital loans and scholarships, providing a convenient alternative to traditional bank loans. Through these services, students can easily apply for and receive loans or scholarships without having to visit a physical branch. This is particularly beneficial for students from low-income families or those studying abroad, who may not have access to traditional banking services.

Moreover, e-banks often have lower interest rates and more favorable terms for loans and scholarships, making education more affordable for students. By leveraging technology, e-banks are revolutionizing the accessibility and affordability of higher education.

Enhancing Financial Literacy through Online Banking Tools and Resources

Financial literacy is a crucial life skill that students need to acquire. E-banking offers an innovative way to educate students about personal finance, budgeting, and managing their money. With the incorporation of interactive tools and resources, e-banking not only simplifies financial transactions but also helps students develop essential financial management skills.

Budgeting and Expense Tracking

Many e-banking platforms now offer budgeting tools, allowing students to set budgets for different categories of expenses, track their spending, and receive alerts when they exceed their set limits. This promotes responsible spending habits and helps students stay on top of their finances.

Additionally, by providing real-time updates and detailed transaction histories, e-banking enables students to have a better understanding of where their money is going. This helps them make informed financial decisions and avoid overspending.

Financial Literacy Resources and Workshops

E-banks also offer resources such as articles, videos, and webinars on financial literacy that are easily accessible through their online platforms. These resources cover various topics like budgeting, saving, investing, and managing debt. Some e-banks even organize workshops and seminars for students to learn more about personal finance from industry experts.

By integrating financial literacy resources into their services, e-banks are equipping students with the knowledge and skills needed to make sound financial decisions throughout their lives.

Ensuring Secure Transactions and Data Privacy in E-Banking for Students and Institutions

Security and data privacy are critical concerns in the digital age, and e-banking is no exception. As students increasingly rely on e-banking for their financial needs, it is essential to ensure that their transactions and personal information are secure.

Two-Factor Authentication

To combat cyber threats and protect customer data, most e-banking platforms now use two-factor authentication. This requires users to enter a security code or use biometric authentication, such as fingerprint or facial recognition, to access their accounts. This added layer of security significantly reduces the risk of unauthorized access and identity theft.

Encryption and Secure Servers

E-banks also use encryption technology to safeguard sensitive information, such as account details and passwords. This ensures that data transmitted between the user’s device and the e-bank’s servers is indecipherable to any third party attempting to intercept it.

Furthermore, e-banks invest in secure servers and regularly conduct security audits to identify and address any vulnerabilities in their systems. This ensures that students’ financial information is protected from cyber threats.

Streamlining Access to Educational Resources and Materials through Financial Technologies

One of the most significant challenges faced by students in traditional universities is the high cost of textbooks and educational materials. E-banking can help alleviate this burden by leveraging financial technologies to streamline access to such resources.

Digital Textbooks and Library Resources

E-banks can partner with publishing companies and educational institutions to offer digital textbooks at discounted rates or even for free to students. This not only reduces costs but also eliminates the need for physical copies, making it more convenient for students. Similarly, e-banks can collaborate with academic libraries to provide students with online access to study materials and research databases.

Cashback and Rewards Programs

Some e-banks also offer cashback and rewards programs for certain purchases made using their platform. By partnering with popular brands and retailers, e-banks can provide students with exclusive discounts and offers on educational resources and materials. This makes education more affordable and encourages students to utilize e-banking services.

Addressing the Challenges of Digital Divide and Access to Banking Services for All Students

E-banking has the potential to bridge the gap between students who have access to traditional banking services and those who do not. As more services move online, it is essential to address the digital divide and ensure that all students have equal access to e-banking services.

Mobile Banking and Accessibility

With the rise of smartphone usage, mobile banking has become increasingly popular among students. E-banks offer mobile banking apps that allow students to access their accounts and perform transactions on-the-go, providing them with greater accessibility and convenience.

Moreover, e-banks often have lower minimum balance requirements and do not charge maintenance fees, making them more accessible to students from low-income families. This promotes financial inclusion and empowers students to take control of their finances.

Financial Literacy Programs for Underserved Communities

Some e-banks have taken a step further in addressing the digital divide by providing financial literacy programs for underserved communities. These programs aim to educate individuals about e-banking services and how they can benefit from them. By promoting financial literacy and increasing awareness about e-banking, these initiatives are helping bridge the gap between students with and without access to traditional banking services.

Conclusion

In conclusion, the integration of e-banking with online learning platforms is revolutionizing the way students manage their finances and access educational resources. E-banks offer convenience, security, and financial literacy tools to help students navigate the complexities of personal finance. Furthermore, by addressing challenges like the digital divide and promoting financial inclusion, e-banking is paving the way for a more financially literate and technologically advanced generation. As technology continues to advance, the future looks bright for the marriage of e-banking and online learning, and the potential benefits for students are endless. It is up to universities and educational institutions to embrace these changes and harness the power of e-banking to enhance the learning experience for their students.